Loans up to Rs 7.5 lakh, new courses, more lending institutions in Govt’s revised skill loan scheme

Vagisha Kaushik | July 25, 2024 | 05:42 PM IST | 2 mins read

Model skill loan scheme revised by the skill ministry includes courses such as AI, data science, health care and institutions such as NFBCs, MFI.

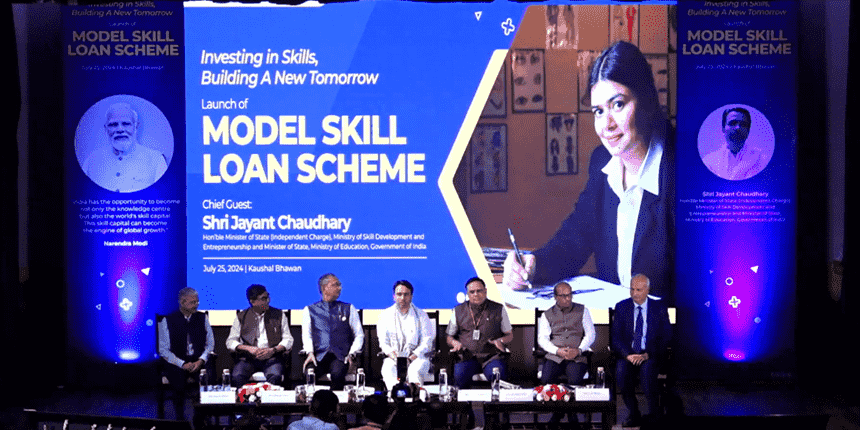

NEW DELHI: The revised model skill loan scheme will facilitate loans up to Rs 7.5 lakh and will cover courses other than those aligned to the National Skill Qualifications Framework NSFQ). Minister of skill development and entrepreneurship Jayant Chaudhary today launched the revised scheme.

The features of the revised skill loan scheme include increase in loan amount from Rs 1.5 lakh to Rs 7.5 lakh, coverage of courses provided they’re available on the Skill India Digital Hub, and extension of loan lending institutions to Non-Banking Financial Company (NBFC)s, Micro Finance Institutions (MFI) and, small finance banks.

With the help of this initiative, aspiring candidates can choose from a plethora of skill courses in sectors such as healthcare, information technology, artificial intelligence (AI), data science, cloud application, digital marketing, hospitality, animation, gaming, graphic designing and drone technology.

The new model skill loan scheme is tailored to support advanced-level skill courses, which often come with higher fees, creating a significant barrier for many deserving students, the minister said during a press conference.

Issues with previous skill loan scheme

Highlighting the issues with the previous loan scheme, Nilambuj haran, senior economic advisor, skill development ministry, said that presently, many loan applications are rejected by pending institutions due to applicants' inability to meet minimum credit requirements such as maintaining an average bank balance and possessing a good credit score.

And earlier this loan was being provided under the Credit Guarantee Fund Scheme for Skill Development which was notified in November 2015. The problem with the scheme was low fund borrowing. As of March 31, 2024 loans amounting to Rs 115.7 crore were extended to 10,077 borrowers. The low ticket loan was due to the fact that the limit was Rs 1.5 lakh. Only member lending institutions who were part of the Indian Bank Association were allowed to disburse the loans.

Ved Mani Tiwari, officiating CEO, NSDC said, "For any product to take off there has to be an enabling environment. Now we have a digital platform called SIDH which will provide information about students, the courses and others." This scheme will also open opportunities for upskilling for the existing workforce, he added.

"It is a really great idea and the demand of the industry. We are going to the nook and corner of the country with the model skill loan scheme," said Jayant Chaudhary. "For the first time, the government is embarking for the future with strategies. It is making plans not just to win elections, but it is thinking of the future,” he further added.

Follow us for the latest education news on colleges and universities, admission, courses, exams, research, education policies, study abroad and more..

To get in touch, write to us at news@careers360.com.

Next Story

]Union Budget 2024: Education loan relief; focus on skills, jobs, internships; Rs 1.48 lakh crore outlay

Education Budget 2024: The finance minister announced 3% education loan interest subvention, e-vouchers for students.; support for youths in first jobs; paid internships in top 500 companies.

Shradha Chettri